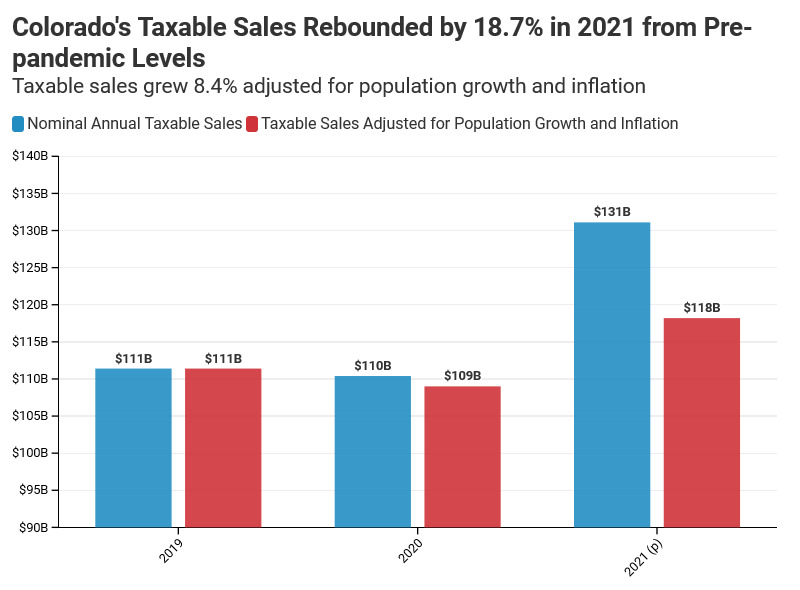

This month marks two years from the start of the economic fallout caused by pandemic related restrictions. As measured by jobs, the Colorado economy is still months away from full recovery. However, economic activity as proxied by taxable sales, generated from the purchase of taxable goods and services, has more than fully recovered. Through the end of 2021, this crucial driver of both state and local sales tax revenue has grown well beyond pre-pandemic levels, even after adjusting for population growth and recent inflation.

- Nominal taxable sales in Colorado in 2021 exceeded those in 2020 by $20.7B (an 18.8% increase) and those in 2019 (pre-Covid) by $19.7B (a 17.7% increase).

- Adjusting taxable sales in 2021 for population growth and inflation, shows they exceeded those in 2020 by $9.2B (an 8.4% increase) and those in 2019 by $6.8B (a 6.1% increase). The rebound in taxable sales was driven by a drop in the unemployment rate from 6.4% in December 2020 to 4.2% in December 2021, as well as a return in consumption and spending patterns resembling those seen prior to the pandemic.

- Inflation and population adjusted non-retail stores taxable sales nearly tripled from $3.7B in 2019 to $9.7B in 2021 reflecting a change in consumers’ purchasing habits towards online retailers and a 2019 law going into effect requiring the collection of sales taxes from out-of-state retailers.

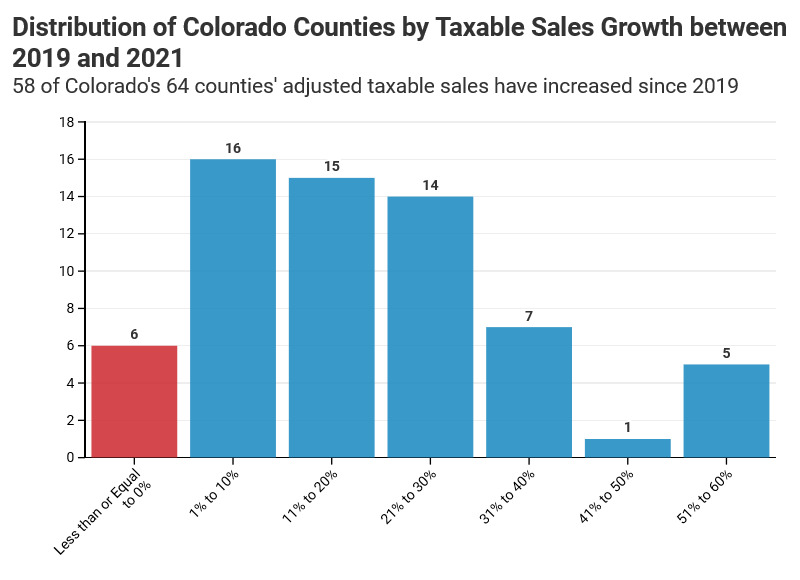

- Growth in taxable sales was not equally shared across all Colorado counties and industries.

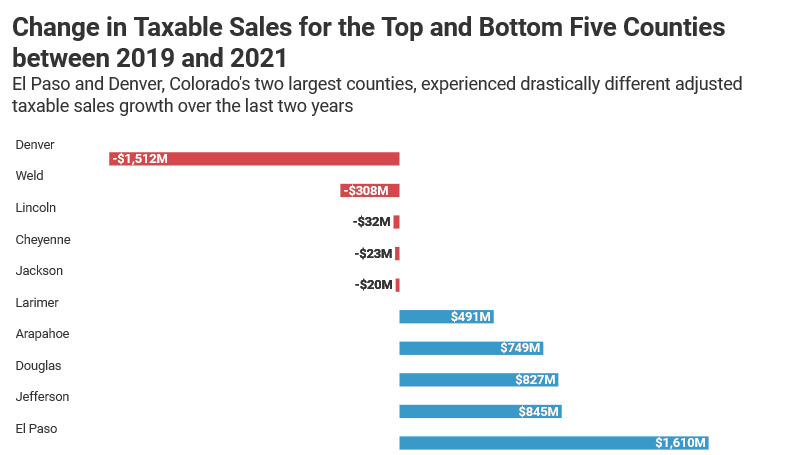

- After adjusting for population growth and inflation between 2019 and 2021, Denver’s taxable sales decreased by $1.5B (-8.5%) whereas, El Paso County had an increase of $1.6B (a 14%). Denver County’s population grew by 14,966 (2.1%) over this period and El Paso’s grew by 12,368 (1.7%).

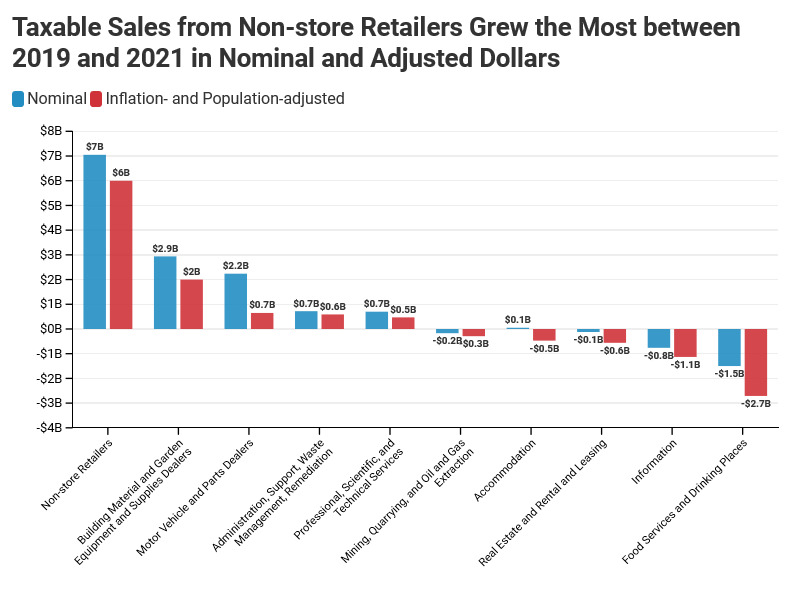

- While non-store retail adjusted taxable sales tripled from 2019 to 2021, food services and drinking places declined by -$2.7B (-19.7%) indicating that the industry has not fully recovered from the impact of Covid-19 related restrictions.

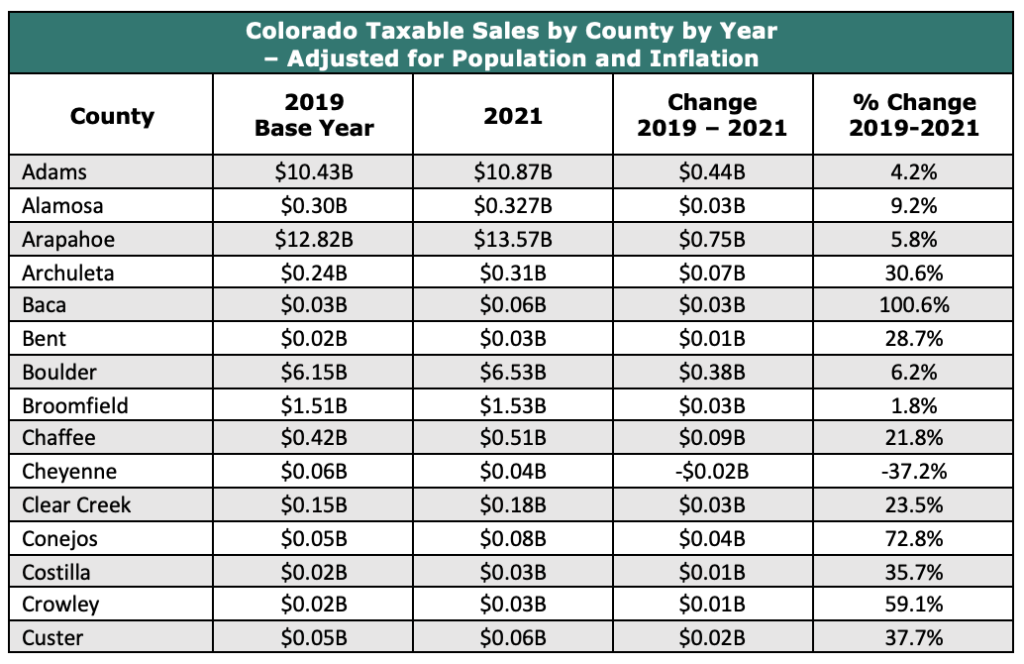

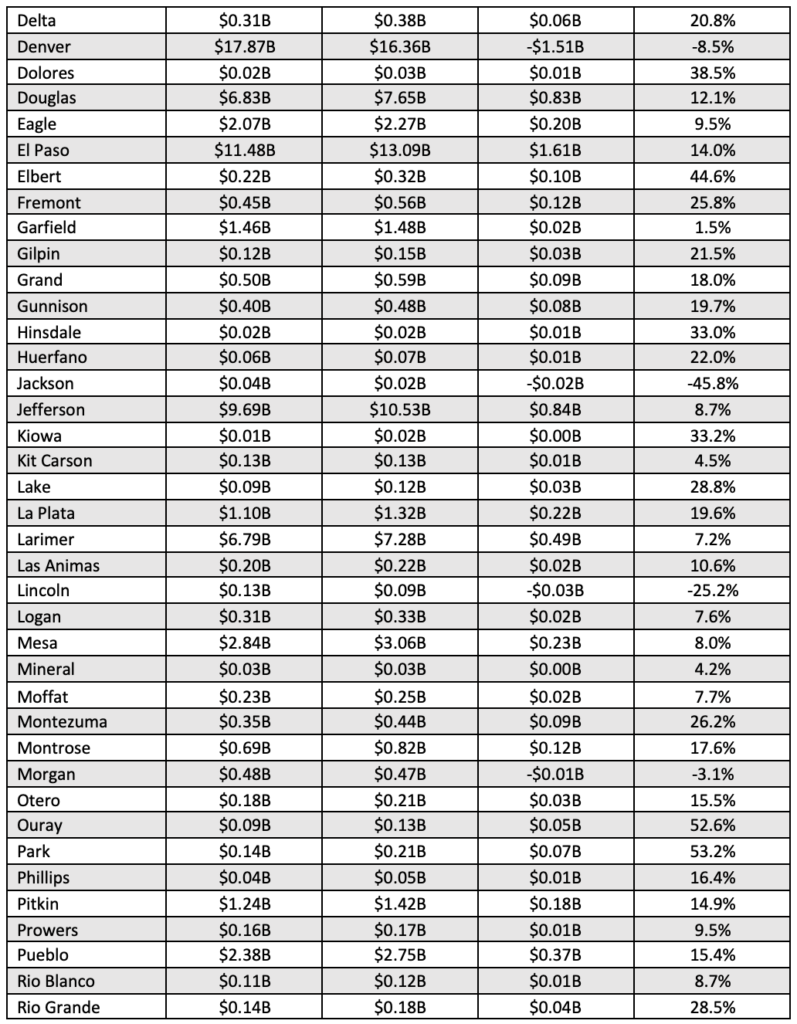

Key Findings by County

The economic rebound by Colorado’s 64 counties from 2019 to 2021, varied in terms of nominal taxable sales. Only three counties: Lincoln (-$22.4M), Cheyenne (-$20.6M), and Jackson (-$18.4M) reported a nominal decrease in taxable sales. These are among the least populated counties in Colorado and primarily agricultural. For all other 61 counties, taxable sales increased ranging from $3.27B in El Paso County, to $6.1M in Mineral County.

- The states most populous county, El Paso County which encompasses Colorado Springs and surrounding cities, experienced the largest nominal increase in taxable sales of $3.26B (28.4%) from 2019 through 2021. Taxable sales adjusted for population growth and inflation grew by $1.61B (14%).

- All 7 counties in the Denver MSA experienced positive nominal growth in taxable sales totaling $9.15B (14%). Adjusting for population growth and inflation, taxable sales grew by $1.8B (2.7%). Within the MSA, Denver’s adjusted taxable sales decreased by 8.5%, while the surrounding 6 counties combined adjusted growth was 6.9%

- Across Colorado six counties had population and inflation adjusted taxable sales growth greater than 40% and six counties had negative growth between 2019 and 2021. The other counties with positive growth saw increases ranging from 1% to 40%.

- In Gilpin County, home to the towns of Blackhawk and Central City, nominal taxable sales increased $42.4M (34.3%) and adjusted taxable sales increased $26.6B (21.5%). Taxable sales in Gilpin County are driven by sales related to gaming traffic such as food & drink and accommodation providing evidence that Coloradoans are still eager to get out and visit the casinos.

- How well a county has performed economically since 2019 is primarily a function of the population of that county and the residential versus commercial mix. Also important is the industrial composition of the county’s commercial enterprises. Many industries found it easier to remain open and to retain employees. Counties heavily reliant on tourism and services like Eagle, Summit, San Miguel, and Pitkin County suffered large drops in visitors in 2020 and have just begun to recover in 2021.

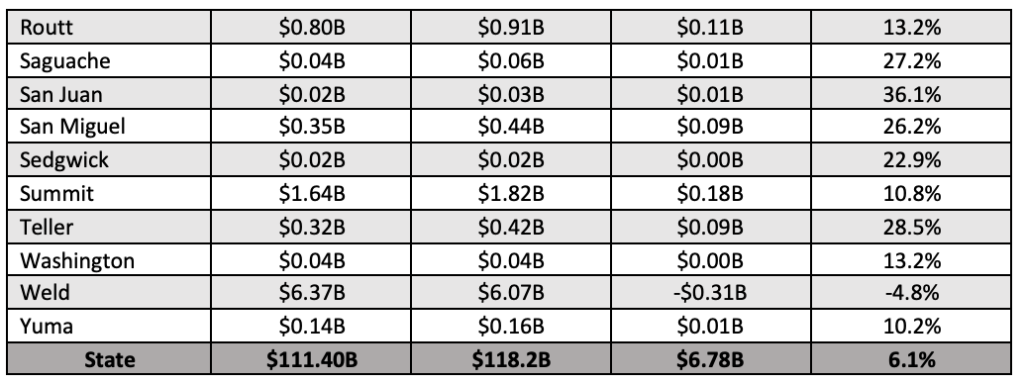

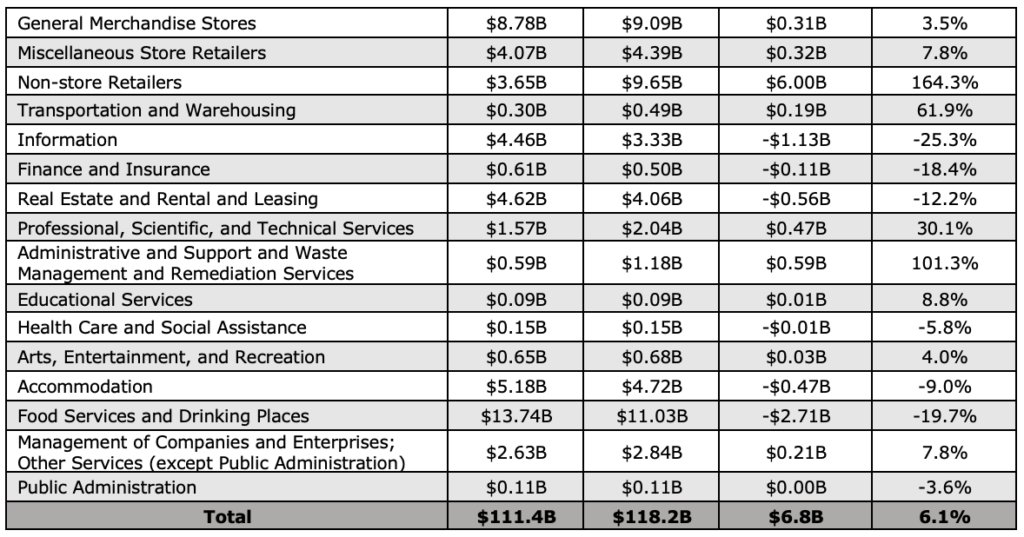

Key Findings by Industry

The economic recovery from 2020 was unevenly distributed among 31 industrial sectors reported by the Colorado Department of Revenue and not all industries have posted taxable sales greater than they had in 2019. The top five industries and bottom five industries change in nominal (population and inflation adjusted) taxable sales from 2019 to 2021, shown in the following graph, vary from an increase of $7.1B ($6.0B) for non-store retailers (goods and services sold via internet) to a decrease of -$1.5B (-$2.7b) in food services and drinking places.

- Non-store retail (internet based) taxable sales adjusted for inflation and population growth have nearly tripled since 2019 ($3.7B) to $9.7B in 2021, accounting for 8.8% of the 2021 total. This $6B increase in non-store retail sales is undoubtedly due to consumers avoiding in-person shopping and making their purchases over the internet. However, the bulk of the increase is a result of the passage of B. 19 – 1240[i]. The Colorado Department of Revenue implemented the bill in late 2019 and began requiring all businesses who sell goods to customers in their state to assess sales tax based on the customer’s address, not the location of the business.

- Food Service & Drinking Places was higher in 2021 relative to 2020 but had not yet returned to 2019 levels. Adjusted taxable sales for Food Service & Drinking Places was down -$2.7B (19.7%) from 2019. This is most likely the result of many businesses permanently closing in 2020/21 following the government enforced Covid-19 restrictions as well as travel and consumption patterns not returning to pre-pandemic levels.

- To the relief of the Accommodations industry 2021, nominal taxable sales increased relative to 2020 after declining $1.9B (38%) from 2019. However, adjusted taxable sales are still $468M

(-9%) lower than 2019 figures indicating that business and personal travel are slowly returning but has not yet fully recovered to pre-pandemic levels.

- Building Materials and Garden Supplies also benefitted from people being furloughed and working from home. Many workers invested in home offices and other home improvement projects, and as such 2021’s adjusted taxable sales were up $2B (30.6%) from 2019.

- For the 31 industry sectors reported, 20 saw an increase in adjusted taxable sales in 2021 over 2019 and 11 saw a decrease.

Looking Forward

As Colorado moves farther past the economic interruption caused by the Covid-19 related lockdown, we expect taxable sales to continue to rebound. However, inflation is a real risk to economic growth. Inflation of 7.9% over the previous 12-months cost the average Colorado household more than $2,900 according to CSI’s February inflation report[ii]. The Federal Reserve has signaled its intention to raise short-term interest rates and reduce quantitative easing which will likely increase long-term interest rates. In the past, actions by the Federal Reserve to tackle inflation have typically resulted in economic contractions.

Additionally, federal covid – 19 relief aid such as PPP loans, unemployment insurance, direct stimulus payments to households and federal stimulus transfers to states have ended. If employment and labor force participation do not return to pre-pandemic levels the economic performance of Colorado could be held back.

Data Sources

Colorado Department of Revenue: Sales Reports[iii]

U.S. Census Bureau: Census.gov

U.S. Bureau of Labor Statistics: CPI Home (bls.gov)

© 2022 Common Sense Institute

[i] Governor Polis signs HB19-1240 into law | Department of Revenue – Taxation (colorado.gov)

[ii] Microsoft Word – CSI_INFLATION_REPORT_FEB2022_FINAL.docx (commonsenseinstituteco.org)