Illinois’ billions: Pension debt and unpaid bills total more than $140B

Fiscal mismanagement by Illinois politicians has resulted in mounting deficits that are hurting the state’s economy, leading to ever-higher taxes, and driving people and their income out of the state.

Illinois Gov. Bruce Rauner’s budget office estimates the state will have a budget deficit of over $5 billion by the end of fiscal year 2017, and billions more in the years to come. The Illinois comptroller’s website shows the state has a $10 billion mountain of unpaid bills. And the General Assembly’s analysts have announced the state’s pension debt has spiked to a record $130 billion.

For many, tax hikes look like the only solution to Illinois’ fiscal woes. But tax hikes will only make things worse. Illinoisans are already burdened with some of the highest taxes in the nation, including the highest property taxes of any state.

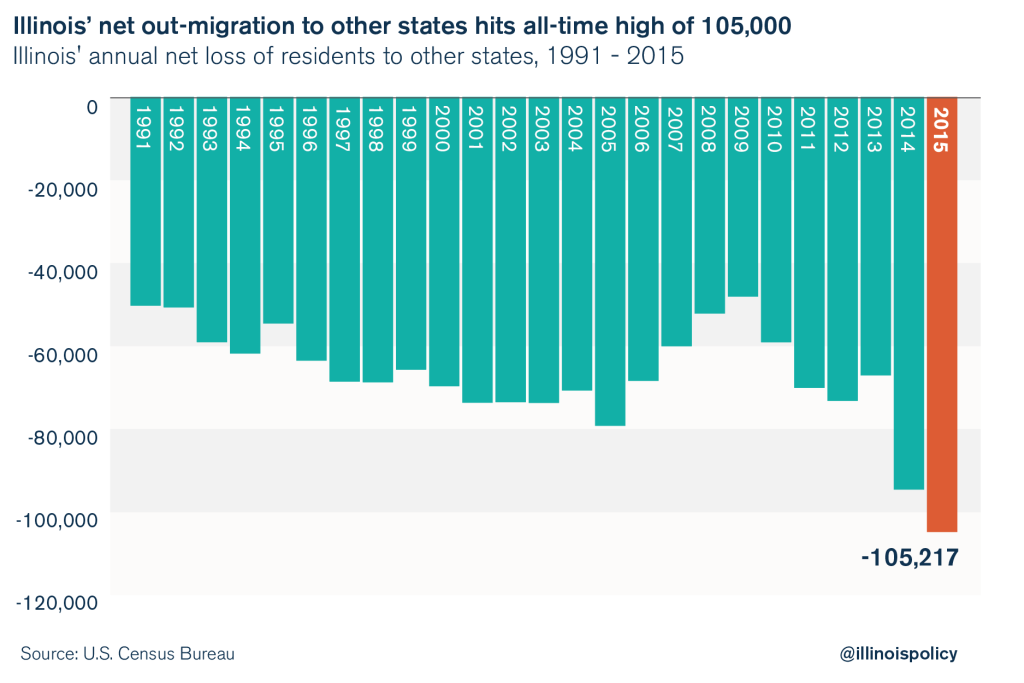

As a result of Illinois’ dysfunction, the state is bleeding people and its tax base. Between July 2014 and July 2015, approximately 300,000 people left Illinois for good and only 200,000 moved in, according to the U.S. Census Bureau. This resulted in a loss of 105,000 residents on net to other states – an all-time high for Illinois. Tax hikes will only chase more residents away.

The only way to keep Illinoisans here is to bring fiscal sanity back to the state through major spending reforms that bring Illinois’ budget in line with what ordinary Illinoisans can afford.

Here is a look at Illinois’ financial crisis, and its impact on the state:

- Annual budget deficits to exceed $30 billion over 5 years

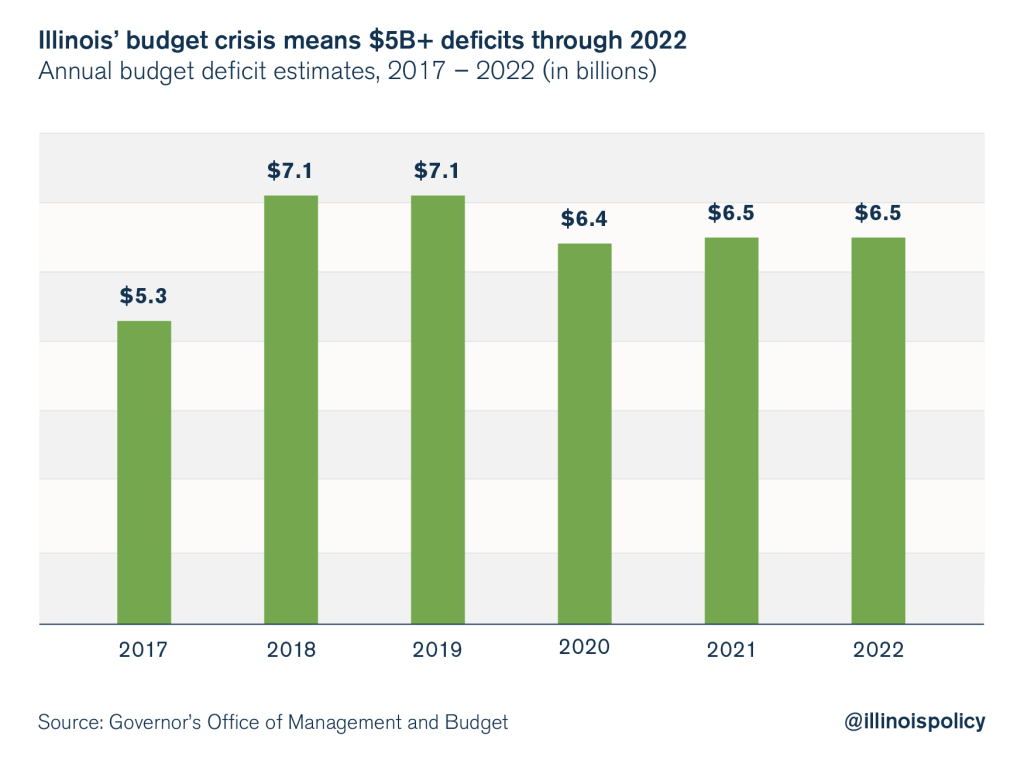

As part of its annual report to the General Assembly, the Governor’s Office of Management and Budget, or GOMB, released the state’s five-year budget projections through 2022.

Those numbers project the state ending fiscal year 2017 with more than $5 billion in deficits, a record for Illinois. The deficits get worse going forward, however, as the annual shortfalls jump to more than $7 billion in 2018 and 2019.

The impetus for those shortfalls is the large increase in projected spending in 2017, when stopgap budgets and court-ordered spending are expected to send total expenditures soaring to $39 billion. That’s 10 percent more than was spent in 2015, the last year Illinois operated under a full budget.

And by 2022, total general fund spending will rise to $43 billion, another 11 percent compared with 2017.

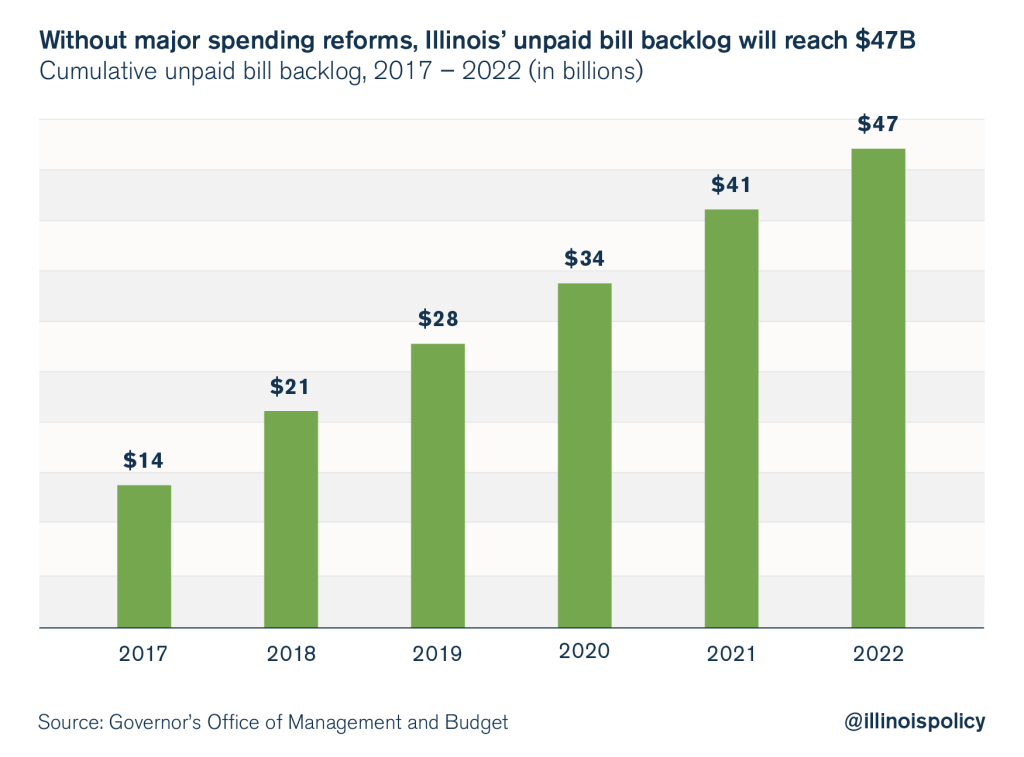

- Unpaid bills to skyrocket to $47 billion by 2022

Every year the state spends more money than it has, vendors wait longer for payment. Social service nonprofits, on average, wait almost a year to get paid for the services they provide to the state’s low-income families, residents with disabilities and seniors. Many agencies have closed their doors, unable to pay their employees and rent.

A stack of unpaid bills is not a new phenomenon in Illinois. Even when the state hiked income taxes and generated over $31 billion in new tax dollars from 2011 through 2014, vendors suffered.

And the comptroller’s latest information shows the pile of unpaid bills has grown to more than $10 billion.

Tack on GOMB’s latest yearly deficit estimates and, barring major reforms, the total backlog will grow to $47 billion by 2022.

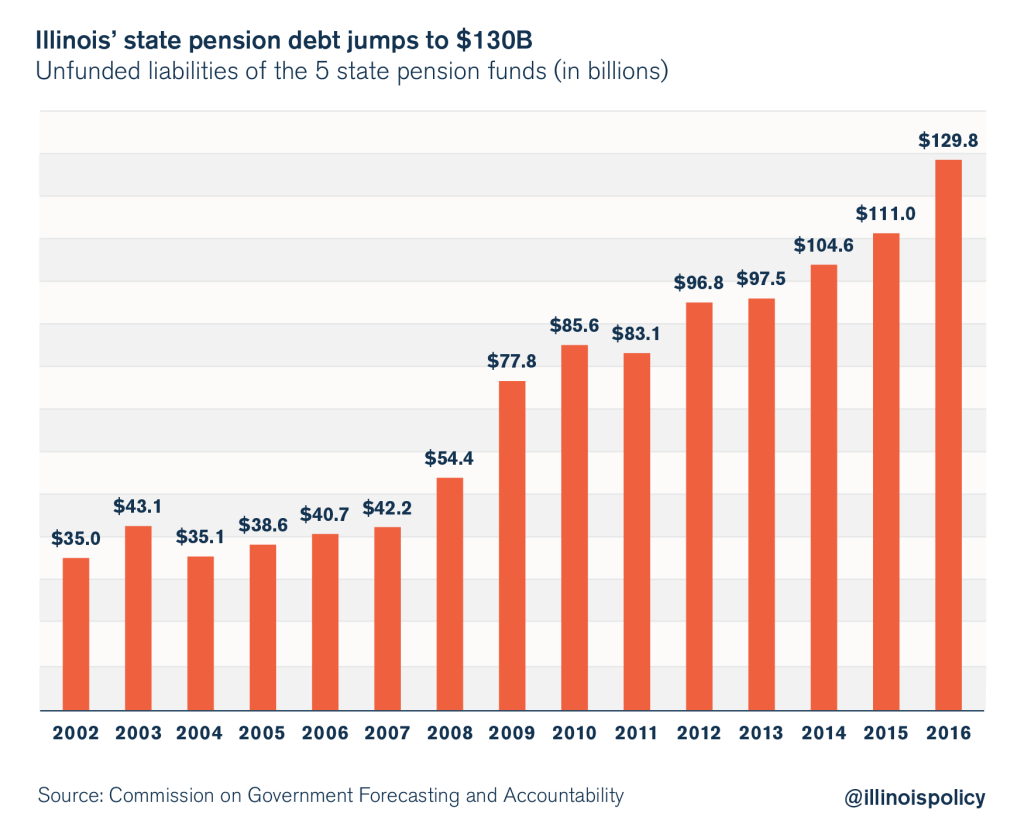

- Pension debt jumps to record $130 billion, or $27,000 per household

A key reason for Illinois’ growing stack of unpaid bills is pensions. Government-worker pensions now consume more than 25 percent of the state’s budget, and they are crowding out everything from education to social services.

According to a new report by the Commission on Government Forecasting and Accountability, Illinois’ pension shortfall in 2016 reached $130 billion, its highest level ever. The shortfall is almost four times higher than it was in 2002, despite massive contributions from taxpayers since then. In just the past year alone, the pension shortfall spiked over 17 percent.

The increase means Illinois households are now on the hook for more than $27,000 in pension debt each, up from $7,600 in 2002.

And even as taxpayers put in more, state worker retirement security continues to collapse. The state pension funds now have only 38 cents on hand for every dollar they need today to pay out future benefits. Without major pension reforms, future retirees may see large cuts in their pension checks.

The impact

It shouldn’t be surprising that after years of politicians’ mismanagement and disregard for taxpayers, Illinoisans are leaving in record numbers. And it could get worse. A Paul Simon Public Policy Institute poll in October found 47 percent of Illinoisans want to leave the state.

Many residents are doing the math – and they’re dreading a hike in future tax bills. Taxes were the single biggest reason Illinoisans wanted to leave the state, according to the Paul Simon Public Policy Institute poll.

For others, the calculus may not be so precise. They can’t find jobs, or simply can’t make ends meet and are forced to find their futures elsewhere.

As residents leave, Illinois loses both people and its tax base.

As noted above, on a net basis, Illinois lost 105,000 residents to other states in 2015. That’s one person every five minutes, an all-time high.

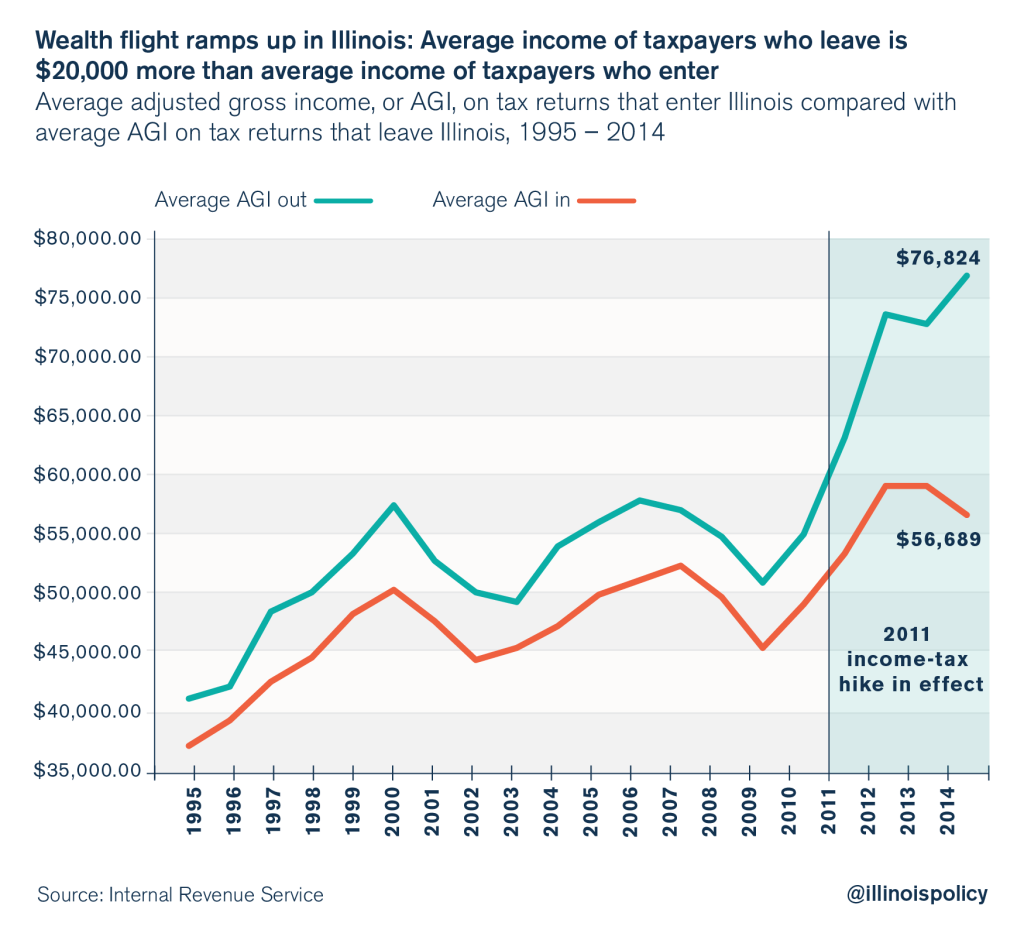

Illinois’ tax base shrinks in the wake of that out-migration. The people who left Illinois earned, on average, $20,000 more than the people who entered the state. That income differential magnifies the effect of Illinois’ withering tax base.

Illinois’ political class might not take the state’s crisis seriously, but residents aren’t ignoring the state’s dire budget numbers. They’re leaving.